Understanding Online Payday Loans in Kansas

In the fast-paced world of finance, online payday loans in Kansas have emerged as a convenient solution for those facing unexpected expenses. These short-term loans offer quick access to cash, enabling borrowers to tackle emergency needs without the lengthy approval processes associated with traditional lending. As Kansans navigate the challenges of budgeting and financial planning, understanding the benefits and implications of these loans is esencial for making informed decisions in times of urgency.

Boost Your SEO with Our Keyword Tracking Service!

Improve your search engine rankings and drive more relevant traffic to your website.

Learn More!Are online payday loans legal in Kansas?

Yes, online payday loans are legal in Kansas, but they are regulated and have specific limits on loan amounts and interest rates.

Are payday loans permitted in Kansas?

In Kansas, payday lending is legal, providing residents with short-term financial options when needed. The state imposes a $500 limit on these loans, ensuring borrowers do not overextend themselves. With a minimum loan term of just 7 days and a maximum of 30 days, borrowers can access quick funds without long-term commitments. Additionally, the finance charges are capped at $15 per $100 borrowed, promoting responsible lending practices and protecting consumers from excessive fees.

Which loan is the simplest to obtain right away?

When seeking immediate financial assistance, it's essential to consider loan options that offer quick approval, especially for those with less-than-perfect credit. Payday loans, no-credit-check loans, and pawnshop loans are among the most accessible types of loans available. These options allow borrowers to secure funds rapidly, making them appealing for urgent needs.

However, while these loans may be easy to obtain, it's esencial to approach them with caution. The terms and conditions can vary significantly, and many of these loans come with high interest rates and fees. Understanding the fine print is vital to avoid falling into a cycle of debt that can arise from high repayment costs.

Before committing to any loan, take the time to evaluate your financial situation and consider alternative options that may be more sustainable in the long run. Exploring community resources or personal loans from friends and family can sometimes provide a better solution without the burdensome costs associated with quick loans. Always prioritize informed decision-making to ensure your financial health remains intact.

What is the maximum number of payday loans allowed in Kansas?

In Kansas, borrowers need to be aware of the state's regulations regarding payday loans. Specifically, the law prohibits lenders from having more than two outstanding loans to a single borrower at any given time. This measure is designed to protect consumers from falling into cycles of debt and ensures that individuals can manage their financial obligations more effectively. Understanding these limits can help borrowers make informed decisions and avoid potential pitfalls associated with multiple payday loans.

Quick Insights into Kansas Payday Lending

Kansas payday lending operates under a unique framework that aims to balance consumer access to credit with protective regulations. Borrowers in Kansas can secure short-term loans, typically due on their next payday, but they must navigate strict interest rate caps and lending limits designed to prevent predatory practices. This regulatory environment encourages responsible lending while ensuring that individuals in need of quick cash can do so without falling into a cycle of debt. As the landscape of payday lending evolves, ongoing discussions about reform and consumer protection continue to shape the future of accessible financial solutions in the state.

Navigating the World of Online Loans

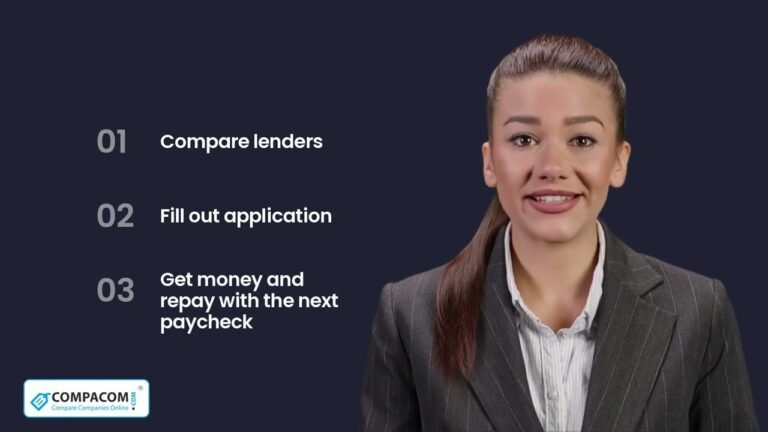

In today’s digital age, online loans have emerged as a convenient financial solution for many. With just a few clicks, borrowers can access funds for various needs, from home renovations to unexpected medical expenses. The streamlined application process typically requires minimal paperwork, allowing individuals to receive approvals in a matter of hours, if not minutes. This accessibility makes online loans an attractive option for those who may struggle to secure traditional bank financing.

However, while the allure of quick cash is tempting, it’s essential to approach online loans with caution. Borrowers should thoroughly research lenders, comparing interest rates and terms to avoid hidden fees that can turn a manageable loan into a financial burden. Additionally, understanding the implications of repayment schedules is esencial, as missing payments can lead to spiraling debt. Educating oneself about the lending landscape can empower borrowers to make informed decisions that align with their financial goals.

Ultimately, navigating the world of online loans requires a balance of convenience and responsibility. By leveraging technology to access funds while remaining vigilant about the terms and conditions, borrowers can take advantage of the benefits these loans offer. With careful planning and consideration, online loans can be a valuable tool in achieving financial stability and meeting urgent needs effectively.

Your Guide to Safe Borrowing in Kansas

When considering borrowing options in Kansas, it’s essential to understand the various avenues available to you. From personal loans to credit unions, each option comes with its own set of terms and interest rates. Researching local lenders can help you find competitive rates and flexible repayment plans that suit your financial situation. Take the time to compare offers and read the fine print to avoid any unexpected fees or charges.

Establishing a solid credit history is esencial for securing favorable borrowing terms. Regularly check your credit report for inaccuracies and work on improving your score by maintaining low credit card balances and making timely payments. A higher credit score not only enhances your chances of loan approval but can also lead to lower interest rates, making borrowing more affordable in the long run.

Lastly, always borrow within your means and create a realistic budget that includes your loan repayments. Assess your current financial situation and future income before committing to any loan. By being informed and cautious, you can make wise borrowing decisions that contribute to your financial well-being and help you achieve your goals without unnecessary stress.

Essential Facts About Payday Loans Online

Payday loans online have emerged as a convenient financial solution for many individuals facing unexpected expenses or cash shortages. These short-term loans typically provide quick access to funds, often with minimal paperwork and fast approval processes. Borrowers can apply from the comfort of their homes, making it an attractive option for those who need immediate assistance without the hassle of traditional banking procedures.

While payday loans online offer quick relief, it's esencial to understand the terms and conditions associated with them. Interest rates can be significantly higher than other lending options, which may lead to a cycle of debt if not managed properly. Borrowers should carefully assess their repayment capabilities before committing to a loan, ensuring they can meet the deadlines to avoid additional fees and charges.

Moreover, responsible borrowing practices are essential when considering payday loans. It's advisable to explore alternative funding options, such as credit unions or personal loans with lower interest rates, before proceeding. For those who decide to take out a payday loan, creating a budget and a repayment plan can help mitigate potential financial strain, allowing for a more secure financial future without the burden of overwhelming debt.

Navigating the world of online payday loans in Kansas offers a quick solution to financial needs, but it’s essential to approach this option with caution. By understanding the terms, evaluating lenders, and considering alternatives, borrowers can make informed decisions that safeguard their financial health. Empowering yourself with knowledge ensures that the convenience of online payday loans serves as a stepping stone towards stability, rather than a pathway to deeper debt.